Current Ratio Formula Example Calculator Analysis

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Current Ratio vs. Other Liquidity Ratios

If a company has $500,000 in current assets and $250,000 in current liabilities, its Current Ratio is 2 ($500,000 / $250,000), indicating that it has twice the assets to cover its immediate obligations. In simplest terms, it measures the amount of cash available relative to its liabilities. For example, if a company’s current assets are $80,000 and its current liabilities are $64,000, its current ratio is 125%. The current ratio expressed as a percentage is arrived at by showing the current assets of a company as a percentage of its current liabilities. This ratio was designed to assist decision-makers when determining a firm’s ability to pay its current liabilities from its current assets.

Formula and components

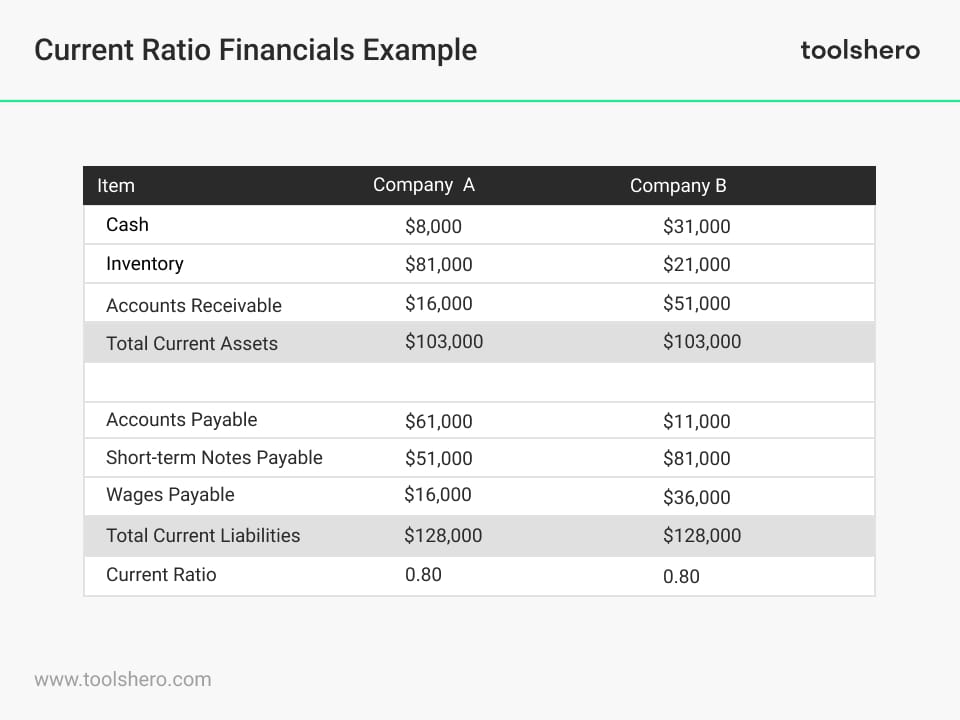

- The above analysis reveals that the two companies might actually have different liquidity positions even if both have the same current ratio number.

- In that case, the current inventory would show a low value, potentially offsetting the ratio.

- A ratio under 1.00 indicates that the company’s debts due in a year or less are greater than its cash or other short-term assets expected to be converted to cash within a year or less.

- Company A has more accounts payable while Company B has a greater amount of short-term notes payable.

- Generally, prepaid expenses that will be used up within one year are initially reported on the balance sheet as a current asset.

Less than 1 means the company has some problems with liquidity, and it may not be able to pay its bills. More than 1 means it’s got more assets than it needs, which is fantastic news — to a point. There are a lot of different ways to evaluate a company’s liquidity, but the current ratio is one that can help you judge just how serious liquidity issues are. These include cash and short-term securities that your business can quickly sell and convert into cash, like treasury bills, short-term government bonds, and money market funds. The volume and frequency of trading activities have high impact on the entities’ working capital position and hence on their current ratio number. Many entities have varying trading activities throughout the year due to the nature of industry they belong.

Formula For Current Ratio

Your company has R500,000 in current assets, R100,000 in inventory, and R200,000 in current liabilities. However, if you learned this skill through other means, such as coursework or on your own, your cover letter is a great place to go into more detail. For example, you could describe a project you did at school that involved evaluating a company’s financial health or an instance where you helped a friend’s small business work out its finances. For example, the inventory listed on a balance sheet shows how much the company initially paid for that inventory. Since companies usually sell inventory for more than it costs to acquire, that can impact the overall ratio. Additionally, a company may have a low back stock of inventory due to an efficient supply chain and loyal customer base.

Possible industry applications of the quick ratio

The above analysis reveals that the two companies might actually have different liquidity positions even if both have the same current ratio number. While determining a company’s real short-term debt paying ability, an analyst should how to start a bookkeeping business 2023 guide therefore not only focus on the current ratio figure but also consider the composition of current assets. Ratios in this range indicate that the company has enough current assets to cover its debts, with some wiggle room.

The power of the quick ratio in financial analysis

Some industries may collect revenue on a far more timely basis than others. However, other industries might extend credit to customers and give them far more time to pay. If a company’s accounts receivables have significant value, this could give the organization a higher current ratio, which could in turn prove misleading. More specifically, the current ratio is calculated by taking a company’s cash and marketable securities and then dividing this value by the organization’s liabilities. This approach is considered more conservative than other similar measures like the current ratio and the quick ratio.

An investor or analyst looking at this trend over time would conclude that the company’s finances are likely more stable, too. High inventory levels can slow liquidity, making the quick ratio a valuable tool to focus on truly liquid assets. It’s ideal to use several metrics, such as the quick and current ratios, profit margins, and historical trends, to get a clear picture of a company’s status.

The cash asset ratio, or cash ratio, also is similar to the current ratio, but it only compares a company’s marketable securities and cash to its current liabilities. This ratio compares a company’s current assets to its current liabilities, testing whether it sustainably balances assets, financing, and liabilities. Typically, the current ratio is used as a general metric of financial health since it shows a company’s ability to pay off short-term debts. The current ratio is a metric used by accountants and finance professionals to understand a company’s financial health at any given moment. This ratio works by comparing a company’s current assets (assets that are easily converted to cash) to current liabilities (money owed to lenders and clients).

My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Note the growing A/R balance and inventory balance require further diligence, as the A/R growth could be from the inability to collect cash payments from credit sales. Suppose we’re tasked with analyzing the liquidity of a company with the following balance sheet data in Year 1.