What Is the Current Ratio? Formula and Definition

The current ratio is a broader measure considering all current assets, while the quick ratio is a more conservative measure focusing only on the most liquid current assets. Analyzing the quality of a company’s current assets can provide insights into its liquidity. For example, a company with a high proportion of current liquid assets, such as cash and marketable securities, may have higher liquidity than a company with a high proportion of inventory. The current ratio can also analyze a company’s financial health over time. Let’s say that Company E had a current ratio of 1.5 last year and a current ratio of 2.0 this year.

Current ratio vs. quick ratio vs. debt-to-equity

Another way a company may manipulate its current ratio is by temporarily reducing inventory levels. This will increase the ratio because inventory is considered a current asset. However, this can also be problematic if the company cannot maintain adequate inventory levels to meet customer demand. By reducing its current liabilities, a company can decrease its short-term debt, improving its ability to meet its obligations.

- A more conservative measure of liquidity is the quick ratio — also known as the acid-test ratio — which compares cash and cash equivalents only, to current liabilities.

- In contrast, a high current ratio may indicate that a company is not investing in future growth opportunities.

- When a company’s current ratio is relatively low, it’s a sign that the company may not be able to pay off its short-term debt when it comes due, which could hurt its credit ratings or even lead to bankruptcy.

- The company has just enough current assets to pay off its liabilities on its balance sheet.

- By generating more revenue, a company can increase its cash reserves and accelerate accounts receivable collections, improving its ability to meet short-term obligations.

How Do the Current Ratio and Quick Ratio Differ?

Excess inventory can tie up cash and reduce a company’s ability to meet short-term obligations. A company can reduce inventory levels and increase its current ratio by improving inventory management. Companies may need to maintain a higher current ratio to meet their short-term obligations in industries where customers take longer to pay.

Focusing Only On The Current Ratio – Mistakes Companies Make When Analyzing Their Current Ratio

The first way to express the current ratio is to express it as a proportion (i.e., current liabilities to current assets). Current ratios are not always a good snapshot of company liquidity because they assume that all inventory and assets can be immediately converted to cash. In such cases, acid-test ratios are used because they subtract inventory from asset calculations to calculate immediate liquidity.

Understanding Solvency Ratios vs. Liquidity Ratios

Conversely, a company that may appear to be struggling now could be making good progress toward a healthier current ratio. The current ratio can be a useful measure of a company’s short-term solvency when it is placed in the context of what has been historically normal for the company and its peer group. It also offers more insight when calculated repeatedly over several periods.

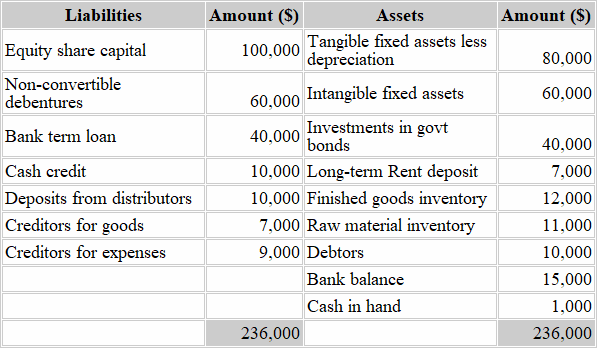

If Company F has a high current ratio, the bank may be more likely to extend credit, suggesting the company can meet its short-term obligations. Company C has a current ratio of 3, while Company D has a current ratio of 2. The current ratio is calculated as the current assets of Colgate divided by the current liability of Colgate.

In addition to the current ratio, it is essential to consider other financial metrics when evaluating a company’s financial health. For example, the debt-to-equity ratio can provide insight into a company’s long-term debt obligations. In contrast, the return on equity can provide insight into how effectively a company uses its assets to generate profits. While Company D has a lower current ratio than Company C, it may not necessarily be in worse financial health. The retail industry typically has high inventory levels, which can increase a company’s current assets and current ratio.

Analysts must be vigilant for such tactics, which can distort the true financial health of a company. Here, the company could withstand a liquidity shortfall if providers of debt financing see the core operations examples of incremental analysis are intact and still capable of generating consistent cash flows at high margins. The range used to gauge the financial health of a company using the current ratio metric varies on the specific industry.

The current ratio only considers a company’s short-term liquidity, which may not provide a complete picture of its financial health. A company may have a high current ratio but still have long-term financial challenges, such as high debt or low profitability. A company with a consistently high current ratio may be financially stable and well-managed.

This means that a company has a limited amount of time in order to raise the funds to pay for these liabilities. Current assets like cash, cash equivalents, and marketable securities can easily be converted into cash in the short term. This means that companies with larger amounts of current assets will more easily be able to pay off current liabilities when they become due without having to sell off long-term, revenue generating assets.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.