Current Ratio Definition, Formula, and Calculation

During times of economic growth, investors prefer lean companies with low current ratios and ask for dividends from companies with high current ratios. In this example, although both companies seem similar, Company B is likely in a more liquid and solvent position. An investor can dig deeper into the details of a current ratio comparison by evaluating other liquidity ratios that are more narrowly focused than the current ratio. For example, in one industry, it may be more typical to extend credit to clients for 90 days or longer, while in another industry, short-term collections are more critical.

Would you prefer to work with a financial professional remotely or in-person?

For example, a retail business may have a higher level of inventory during the holiday season, which could impact its ratio of assets to liabilities. Further, a company may need to borrow more during slow seasons to fund its operations, which could also impact the current ratio. Therefore, applicable to all measures of liquidity, solvency, and default risk, further financial due diligence is necessary to understand the real financial health of our hypothetical company. The company has just enough current assets to pay off its liabilities on its balance sheet.

When Analyzing a Company’s Current Ratio, What Factors Should Be Considered?

However, a below-average ratio can be a sign of poor asset use, and possibly of assets that cannot be easily liquidated. The current ratio is an liquidity ratio that measures whether a firm has enough resources to meet its short-term obligations. It is the ratio of a firm’s current assets to its current liabilities, Current Assets/Current Liabilities.

What does the current ratio tell investors?

- They include cash, accounts receivable, inventory, prepaid expenses, and other assets a company expects to use or sell quickly.

- Its current liabilities, meanwhile, consist of $100,000 in accounts payable.

- Internally, you can use the quick ratio to assess liquidity, plan future expenditures, and identify opportunities to enhance cash flow.

- A large retailer like Walmart may negotiate favorable terms with suppliers that allow it to keep inventory for longer periods and have generous payment terms or liabilities.

- In this example, the trend for Company B is negative, meaning the current ratio is decreasing over time.

- While Company D has a lower current ratio than Company C, it may not necessarily be in worse financial health.

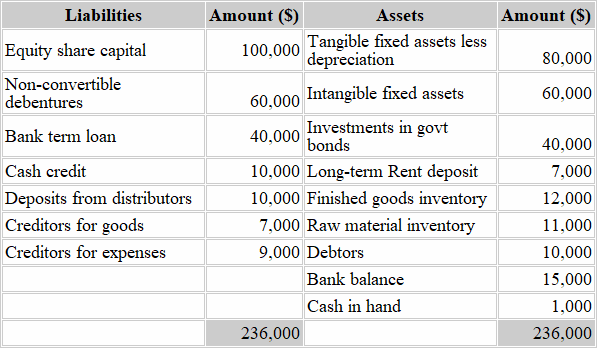

On the other hand, current assets in this formula are resources the company will use up or liquefy (converted to cash) within one year. The current ratio measures a company’s ability to meet short-term obligations. Companies that focus only on short-term financial health may miss important information about the company’s long-term financial health.

Editorial integrity

This current ratio guide will cover everything you need about the current ratio, including its definition, formula, and examples. In other words, “the quick ratio excludes inventory in its calculation, unlike the current ratio,” says Johnson. The denominator in the Current Ratio formula, current liabilities, includes all the company’s short-term obligations, i.e., those due within one year. It encompasses items such as accounts payable, short-term loans, and any other debts requiring repayment in the near future.

Variability in asset composition

We do not include the universe of companies or financial offers that may be available to you. Healthcare providers face cash flow delays due to insurance reimbursements and fluctuating accountingprose blog patient volumes. Professional services firms rely on accounts receivable rather than inventory. Our team is ready to learn about your business and guide you to the right solution.

In this example, Company A has much more inventory than Company B, which will be harder to turn into cash in the short term. Perhaps this inventory is overstocked or unwanted, which eventually may reduce its value on the balance sheet. Company B has more cash, which is the most liquid asset, and more accounts receivable, which could be collected more quickly than liquidating inventory. Although the total value of current assets matches, Company B is in a more liquid, solvent position. Current assets listed on a company’s balance sheet include cash, accounts receivable, inventory, and other current assets (OCA) that are expected to be liquidated or turned into cash in less than one year.

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Current assets refers to the sum of all assets that will be used or turned to cash in the next year.